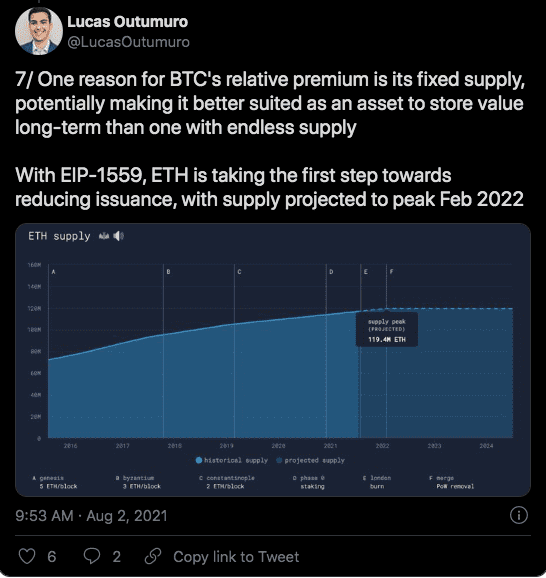

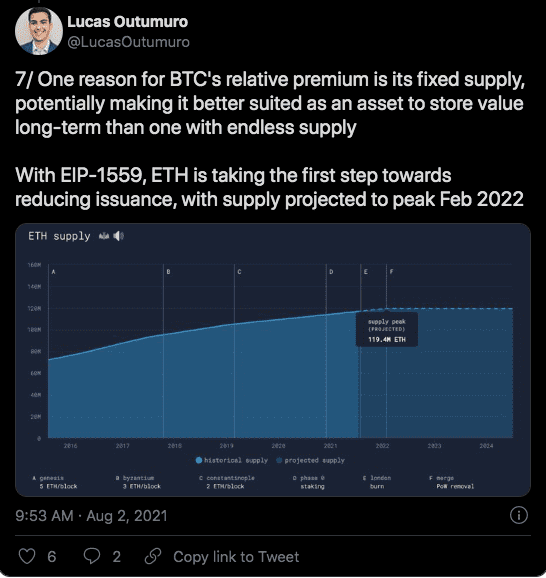

Ethereum’s new update EIP-1559 or “The London Fork”, aims to improve the Ethereum network’s user experience, value proposition, and more. At the time of writing, the currency is trading at its highest price in three months after the update, and is currently on a bullish trend.

Many projects like Difi and NFT operate on the backbone of ethereum. On one hand, these applications keep Ethereum’s value alive, but, at the same time, congestion is one ongoing problem with ETH. When congestion hits, spikes in usage patterns translate into higher gas fees (the cost of processing a transaction).

A key objective of the Improvement Proposal EIP-1559 is to make on-chain experience better by making fees more predictable and friendly for users, not necessarily cheaper

Gas fee friendly payment protocols built on Ethereum (that is, layer 2 infrastructure) will continue to be demanded in the future because of a need to optimize transactions through reduced network congestion . Essentially, this upgrade has changed the fee generation mechanism so that part of the fees are burnt.

“Definitely makes me more confident about the merge.”

Vitalik Buterin

.

There will therefore be a scarcity of ether tokens, thereby causing price pressure since the demand will not decline. The coins that are being removed from circulation are going to help drive down transaction fees which will in return possibly increase the value.

Bitcoin mining identical to Ethruerm mining

A Proof of Work system requires all miners to solve a complex sum, forcing the winner to be determined by the hardware device that has the most power or quantity of devices.

Ethereum’s mining process shares many of the same general functions as Bitcoin.In this regard, both cryptos require a lot of electricity to mine

ETH plans to shift to proof of stake with 2.0, which does not stimulate excessive energy consumption. With a proof-of-stake model, owners put up their tokens as collateral. They are rewarded with authority over their tokens according to how much they have staked.

.