In the labyrinth of personal finance, there exists a beacon of financial wisdom that guides individuals toward financial stability and success: Track Monthly Expenses.

It’s a practice often overlooked but holds immense power in the realm of financial management. Understanding where your money flows, curbing unnecessary spending, and channeling resources toward essential needs and future aspirations are all made possible through diligent expense tracking.

Why Should You Track Monthly Expenses?

Whether you’re looking to escape the shackles of debt, secure your financial future, or gain greater control over your finances; mastering the art of tracking expenses is the first step on your journey to financial well-being. Tracking monthly expenses is a crucial aspect of personal finance management for several compelling reasons:

- Financial Awareness

- Budgeting

- Identifying Overspending

- Debt Management

- Savings and Investment Management

- Preventing Fraud

- Reducing Financial Stress

- Improving Financial Discipline

How-To Track Monthly Expenses

- Understanding Your Spending Patterns

- Regularly review bank and credit card statements to identify recurring payments and large expenses.

- Categorize your expenses into broad categories (e.g., housing, transportation) and subcategories (e.g., groceries, dining out).

- Identifying Red Flags

- Watch for unauthorized transactions and subscriptions you no longer use.

- Creating a Budget

- Allocate 50% to Needs (e.g., rent, groceries), 30% to Wants (e.g., dining out, hobbies), and 20% to Savings and Debt Repayment.

- Using Budgeting Apps

- Choose the right app that suits your needs and sync your accounts for automatic tracking.

- Set alerts and goals to monitor your progress.

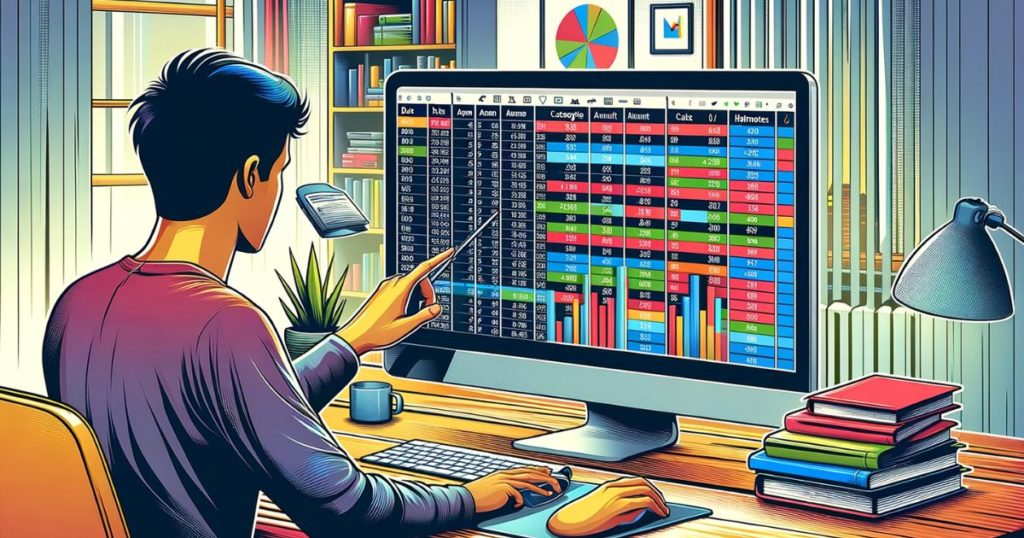

Tracking Your Expenses

- Spreadsheets: Use Excel or Google Sheets for customizable way to track monthly expenses.

- Manual Tracking: Keep a physical ledger or notebook for a hands-on approach.

- Choose a Method that Fits Your Style: Digital tools for convenience or manual tracking for engagement.

Benefits of Expense Tracking

- Awareness and Wise Spending: Understand your spending patterns to make informed financial decisions.

- Financial Accountability and Habit Improvement: Stay accountable to your budget, correct bad spending habits, and reduce financial stress.

- Adapting to Economic Changes: Track expenses to allocate funds effectively in fluctuating economic conditions.

Additional Tips for Saving Money

- Emergency and Unexpected Expenses: Build savings to handle financial emergencies and unexpected costs.

- Career Freedom: Savings provide the freedom to pursue a career you love.

- Financial Security: Savings act as a safety net for financial stability.

- Balancing Fun and Finances: Save to enjoy leisure activities guilt-free.

- Coping with Emergencies: Savings prevent additional financial stress during crises.

Effective Saving Strategies

- Budgeting: Include saving as a category in your budget and set savings goals.

- Cutting Expenses: Identify nonessential expenses and reduce spending.

- Setting Savings Goals: Establish short-term and long-term savings goals.

- Prioritizing Financial Goals: Allocate savings based on your priorities.

- Choosing the Right Savings Tools: Select appropriate accounts for your goals.

- Automating Savings: Set up automatic transfers to your savings account.

- Monitoring Savings Growth: Regularly review your budget and savings progress.

The Importance of Budgeting

- Tracks Spending and Savings: A budget helps track expenses and savings.

- Improves Financial Habits: Budgeting aids in debt management and savings.

- Organizes Finances: It helps organize your financial life.

- Helps in Building Savings: Crucial for saving money.

- Prevents Overspending: Keeps spending in check.

- Provides Financial Control and Planning: Offers organization and accountability.

Tips for Effective Budgeting

- Write Everything Down: Record all expenses.

- Create a Budgeting Schedule: Dedicate time to review your budget regularly.

- Set Reminders: Use reminders to stay on track.

- Ditch Credit Cards: Reduce the number of accounts to manage.

- Set Bite-Sized Goals: Include smaller goals alongside long-term ones.

- Identify and Avoid Spending Triggers: Recognize situations that lead to overspending.

- Save Before Spending: ‘Pay yourself first’ by saving a portion of your income.

- Reduce Dining Out: Cook meals at home to save money.

- Implement the 30-Day Rule: Wait before making impulse purchases.

- Budget for Fun: Allocate a portion for leisure activities.

- Avoid Frequent Phone Upgrades: Limit technology upgrades.

- Eliminate Debt: Work towards paying off all debts.

- Buy Groceries on a Full Stomach: Prevent impulsive buying.

- Log Expenses Daily: Keep your budgeting process manageable.

- Coordinate with Your Spouse: Ensure both partners are aligned.

- Budget for Vacations: Save for leisure activities.

- Focus on Contentment: Avoid comparing your financial situation with others.

- Invest Savings: Watch your money grow by investing.

- Set Realistic Expectations: Set achievable financial goals.

- Celebrate Achievements: Acknowledge and celebrate financial milestones.

Tracking your monthly expenses is a fundamental practice for anyone looking to achieve financial stability, reach their financial goals, and maintain control over their financial well-being. It provides the data and insights needed to make sound financial decisions and avoid common pitfalls that can lead to financial problems